Infographic

4 Modern Bot Attacks Targeting Bank Consumers

See how bots attacking the login and registration flows pose a substantial threat to your financial institution—and why a multi-layered security approach is essential.

What You’ll Learn

- Why modern bots pose a major threat to banks and their customers Insight into how automated attacks overwhelm login and registration flows, mimic human behavior, and drive a significant share of online banking traffic.

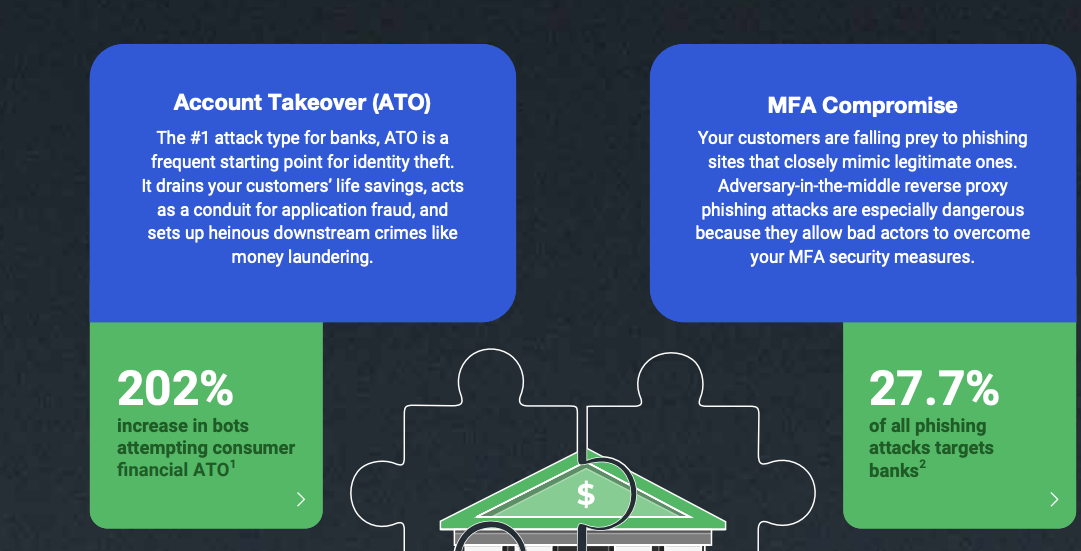

- The four bot-driven attack types most harmful to financial institutions Clear explanations of account takeover, MFA compromise, SMS toll fraud, and new account fraud—and why each has grown more damaging.

- How high-speed automation accelerates identity theft and downstream crimes Understanding how ATO and phishing-driven MFA bypasses open the door to application fraud, money laundering, and account draining.

- Where verification processes introduce new vulnerabilities A look at how SMS-based 2FA, premium-rate messaging, and weak onboarding pathways allow attackers to scale fraud while shifting costs onto banks.

- How defensive controls can disrupt attacker ROI and restore user trust Guidance on how modern fraud platforms detect bots early, protect high-risk touchpoints, and preserve a seamless consumer experience.

FAQ

Why is account takeover such a critical threat for banks?

ATO gives attackers immediate access to sensitive financial information, stored value, and payment mechanisms. Once inside an account, scammers can drain balances, commit application fraud, and set up downstream criminal activity—all while appearing to operate as the legitimate customer.How are attackers bypassing MFA protections?

Banks are increasingly targeted by reverse-proxy phishing sites that perfectly replicate legitimate login pages. These adversary-in-the-middle techniques intercept real-time MFA codes, enabling attackers to break through defenses that were once considered strong.Why is SMS toll fraud such a growing issue for financial institutions?

SMS-based 2FA creates a monetizable vulnerability: fake account sign-ups trigger premium-rate SMS verifications, allowing attackers—often in collaboration with rogue telecoms—to generate revenue at the bank’s expense. High-volume bot automation makes this fraud extremely scalable.What makes new account fraud so costly for banks?

When fraudulent sign-ups succeed, banks face expensive KYC checks, increased operational load, degraded site performance, and higher fraud losses. These resource drains redirect attention away from improving customer experience and genuine user support.