What is new account fraud prevention?

New account fraud prevention involves measures to detect and stop fraudulent activity during the creation of new accounts. This typically includes detecting and mitigating bot activity, identity verification, monitoring suspicious behaviors, and using advanced techniques to identify and stop fraudulent attempts.

Understanding New Account Fraud Prevention

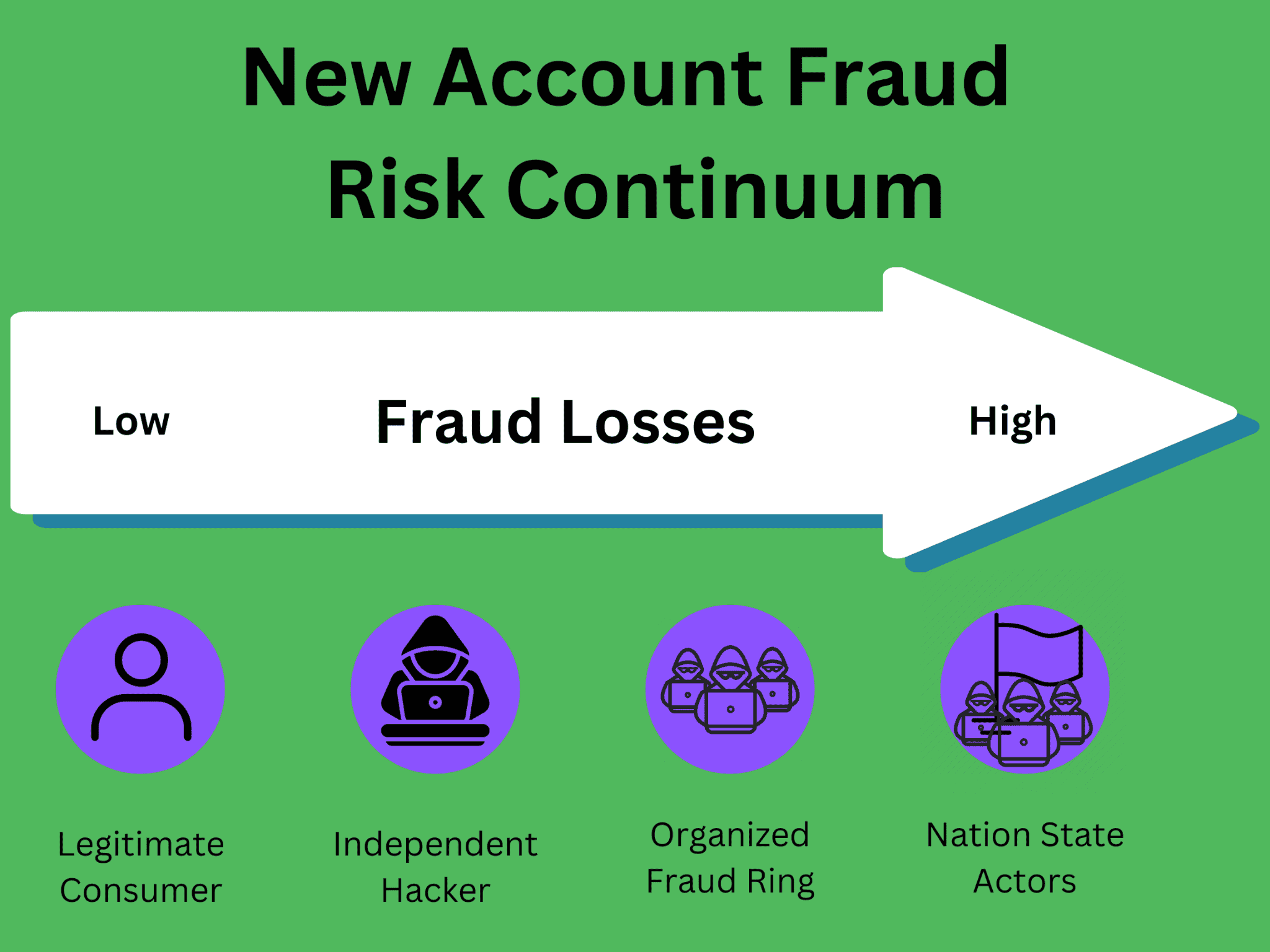

New account fraud heavily relies on data breaches and identity theft to pull together the relevant personal information of consumers. Bad actors use sophisticated methods and tools for fraudulent activity and evasion, which makes it difficult for fraud fighters to distinguish between legitimate and fraudulent activities.

New account fraud prevention is crucial for modern digital businesses, as it poses significant challenges, not only in terms of monetary or reputational losses, but also operational disruption and legal repercussions.

Defining New Account Fraud in the Digital Age

In the simplest terms, new account fraud means creating fraudulent digital accounts using stolen or synthetic ids. Cybercriminals may access consumers’ personally identifiable information (PII) like date of birth, phone number, email address, social security number, credit card, bank account details, and other sensitive and financial information from data breaches or the dark web. Not only is this PII used to mimic legitimate account opening processes but also to bypass security measures.

The Evolution of Fraud Techniques and Tactics

The advancements in technology, combined with a thriving cybercrime ecosystem. is contributing heavily to the evolution of fraud techniques and tactics used in new account creation fraud.

Earlier, fraudsters largely relied on the use of stolen personal information from data breaches to create fraudulent accounts. With the evolution of technology and growing technical skills, attackers have started resorting to synthetic identity theft, with IDs that are stitched together from pieces of real and fake information to create new, seemingly legitimate identities that are difficult to detect.

In recent times, fraudsters have begun leveraging AI-driven methods, bots, and automated tools, to exploit vulnerabilities in real time, scale up the operations, and bypass security measures.

Industries at Risk: A Closer Look

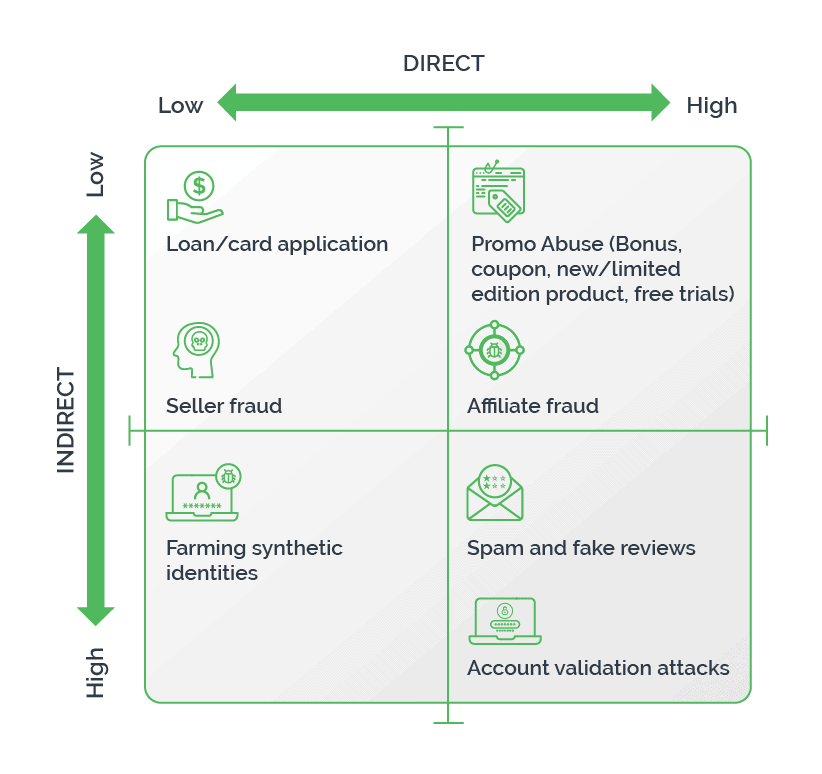

New account fraud poses a significant threat to various industries in the form of financial losses, reputational damage, and operational disruptions. Here is a snapshot detailing how failure in new account fraud prevention can impact various industries,

Banking and Financial Services: Frontline Targets

The banking and financial services industry faces significant risks from new account creation fraud. Cybercriminals may use a stolen identity to register a new bank account to open new credit lines, causing substantial financial losses, damage to brand equity, non-compliance to prevailing regulations, and erosion of customer trust. They also use sophisticated evasion tactics to bypass security measures, making new account fraud prevention that much harder. Efforts to mitigate new account fraud add to the financial burden, strain resources, and impact profitability.

Sharing/Gig Economy: Emerging Vulnerabilities

The decentralized nature of transactions and the reliance on user-generated profiles makes the sharing and gig economy particularly vulnerable to new account fraud. Fraudsters open new accounts to access the services, execute scams, or engage in fraudulent transactions. This not only causes financial losses for both platform operators and legitimate customers, but also damages the trust and reliability essential to these platforms.

Online Dating Platforms

With the growing popularity of online dating platforms, scammers are exploiting these digital channels to create new customer profiles and scam users emotionally and financially. Generally, scammers use these fraudulent accounts for romance scams, where unsuspecting users are manipulated into sending money or sharing sensitive information, leading to financial losses and significant emotional distress to victims. New account fraud prevention is particularly difficult in this industry, as scammers leverage the anonymity and ease of creating profiles on these platforms.

Big Tech

Big Tech companies enjoy a large scale of user base and handle vast amounts of consumers’ personal data. This makes them highly susceptible to new account fraud. Hackers exploit these platforms by creating fake accounts to spread misinformation, conduct advanced phishing attacks, or other malicious purposes.

New account fraud in big tech can lead to data breaches, financial losses, and loss of user trust, causing significant reputational and operational challenges.

Online Gaming and Gambling

In the online gaming and gambling platforms, bad actors create fake accounts to exploit promotional offers, launder money, or engage in cheating schemes, causing financial losses for both operators and legitimate users as well as undermining the integrity and fairness of the platforms. Due to the global scale of operations and the anonymity afforded by the internet, new account fraud prevention in the online gaming and gambling industry is challenging.

Retail and E-commerce

In the e-commerce and retail businesses, fraudsters create fake new accounts to make fraudulent purchases and abuse promotions. This not only affects the revenues for the business but also leads to erosion of customer trust.

Telecommunications

By creating fake accounts, fraudsters target telecommunications companies to obtain expensive devices and services. This causes inventory losses to the affected businesses and raises their operational costs.

Healthcare

In the healthcare industry, new account fraud can result in false insurance claims and unauthorized access to medical services, leading to compromise of patient data and increased insurance premiums.

The Anatomy of a New Account Fraud Attack

From obtaining or fabricating consumers’ personal information to creating a fake account and monetization, there are several stages of a new account fraud attack.

Stages of Fraudulent Account Creation

The stages of new account fraud attack generally include:

- Data Acquisition: Obtain personally identifiable information of consumers through various means, including data breaches, phishing attacks, or purchasing data on the dark web.

- Identity Fabrication: Create a synthetic identity or impersonate a real individual using a combination of stolen data with fabricated details to pass identity verification checks.

- New Account Registration: Use the fabricated identity for new account origination and avoiding detection on online platforms, financial institutions, or other services, by exploiting weaknesses in the application processes.

- Execution of Illicit Activities: Exploit the new fake account for personal gain by engaging in fraudulent activities such as unauthorized purchases, accessing financial services, or conducting scams, while evading detection.

Tools and Technologies Utilized by Cybercriminals

The growing sophistication and availability of cybercrime toolkits, expertise, and crime-as-service, has made new account fraud easy to execute at scale and without getting detected. Fraudsters use commoditized tools such as malware, including keyloggers, ransomware, and remote access Trojans, to steal sensitive information, encrypt files, or gain unauthorized access to systems.

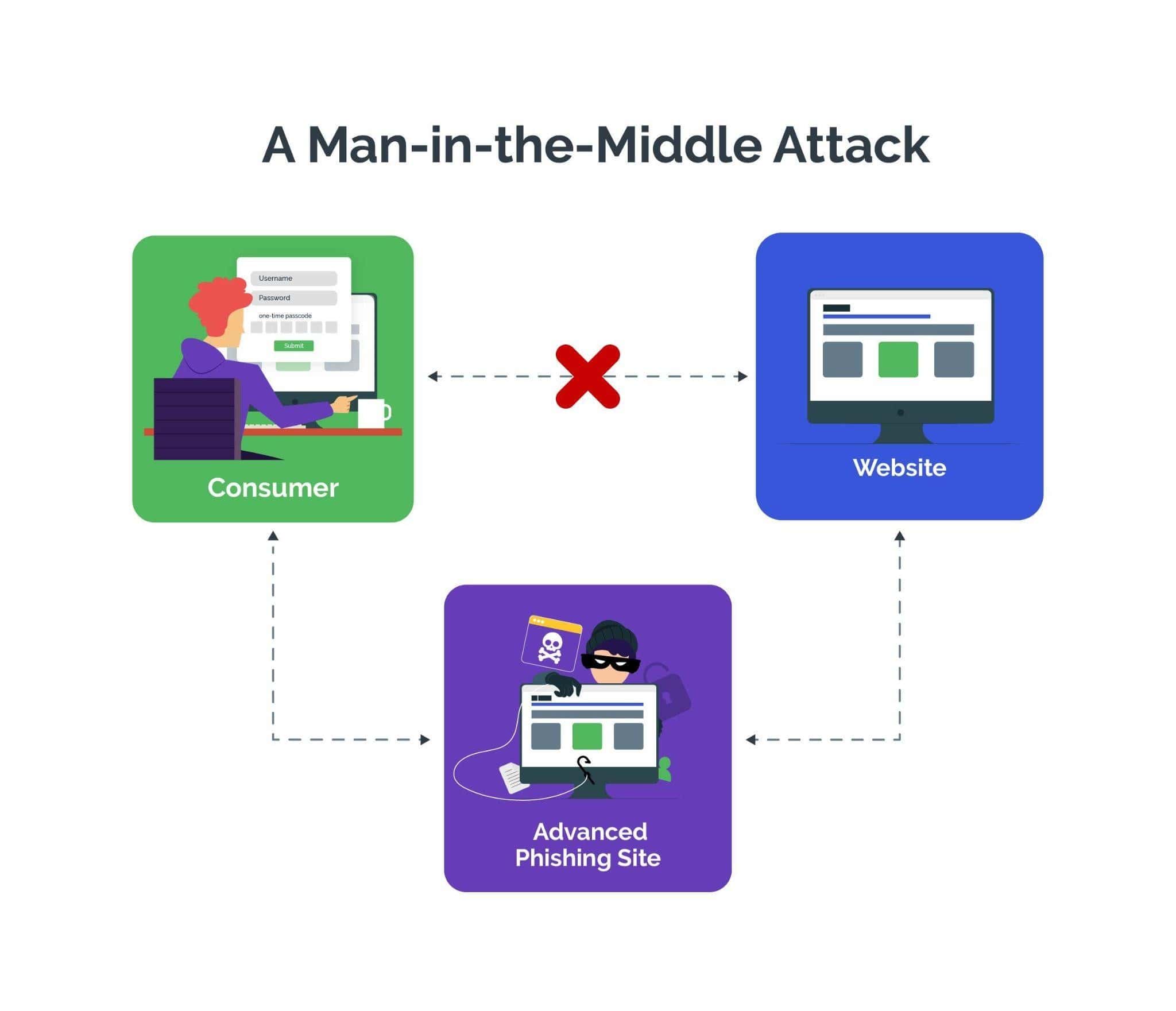

Phishing kits and social engineering tactics are widely used for deceptive emails or fake websites designed to mimic legitimate ones, and trick users into disclosing personal information or login credentials.

Cybercriminals use automated scanning tools and kits to exploit vulnerabilities in software and networks, to launch attacks on a large scale with minimal effort or investment. They extensively use bots and botnets to execute distributed denial-of-service (DDoS) attacks, steal sensitive data, or distribute malware.

To facilitate illicit transactions and launder money, cybercriminals are increasingly using cryptocurrencies to leverage their pseudonymous nature and decentralized structure for evasion or detection.

Using spoofing and anonymizing technologies such as use of virtual private networks (VPNs) and the TOR network, cyber criminals can easily conceal their identities and geographic locations, making new account fraud detection challenging for the security teams.

Role of Bots

Bots facilitate new account fraud by automating various stages of the process involved. Attackers program bots to exploit vulnerabilities in online registration systems, such as weak authentication mechanisms or lack of robust identity verification procedures. Large volumes of bot traffic enables attackers to create thousands of fake accounts using synthetic or fake identities in no time, allowing scaling up of the fraudulent activities efficiently.

Powered by the advancements in bot technology, bots have become intelligent and can mimic human behavior to adapt to the changes in bot detection measures. They can easily solve legacy CAPTCHA challenges, bypass IP address blocking, and other anti-fraud mechanisms, making it difficult for fraud fighters to distinguish between genuine customers and fraudulent bots, thereby failing new account fraud prevention measures.

Bots often supplement other cybercrime tactics, such as phishing attacks or data breaches, to help hackers obtain users’ personal information needed to create fake accounts. As a result, bot-driven new account fraud poses a big challenge for businesses across industries. Businesses must use smart bot management software such as Arkose Bot Manager to effectively counter automated bot attacks.

Impact on Businesses: Beyond Financial Losses

Beyond financial losses, new account fraud leads to erosion of customer trust and damage to brand reputation. This can result in long-term damage, such as reduced customer loyalty and decreased market competitiveness. Businesses may face regulatory action, legal liabilities, and operational disruptions.

Operational Disruption and Brand Damage

Operational disruption and brand damage are significant consequences of new account fraud.

Unchecked new account fraud attacks can cause operational challenges for businesses, including increased customer service inquiries, resource-intensive fraud investigations, and system overloads. This not only disrupts normal business operations but also strains internal resources and degrades user experience, ultimately leading to loss of productivity and revenue.

In the age of social media, negative publicity about fraudulent activities can quickly tarnish a company's reputation as irate customers may label the business as negligent or untrustworthy, causing loss of customer trust and business opportunities. Reputational loss can be a rather long-term damage, requiring the affected business to invest in several corrective measures such as extensive communication, enhanced security measures, and transparent disclosures about the steps taken to prevent future attacks.

Legal Implications and Compliance Challenges

Failure in new account fraud prevention can expose businesses to legal implications and compliance challenges, such as lawsuits from affected customers seeking compensation for financial losses or damages resulting from identity fraud.

The affected business may face regulatory scrutiny and fines for non-compliance with data protection laws and industry regulations governing the handling of personal information. This is especially important in highly-regulated industries like finance and healthcare, where it is mandatory for businesses to protect sensitive consumer data.

Another big challenge for businesses is navigating the complex compliance requirements. Businesses must ensure that their new account fraud prevention measures adapt to the evolving regulatory standards, while maintaining a seamless user experience. This is especially true for businesses operating globally and contending with varying regulatory requirements across diverse jurisdictions.

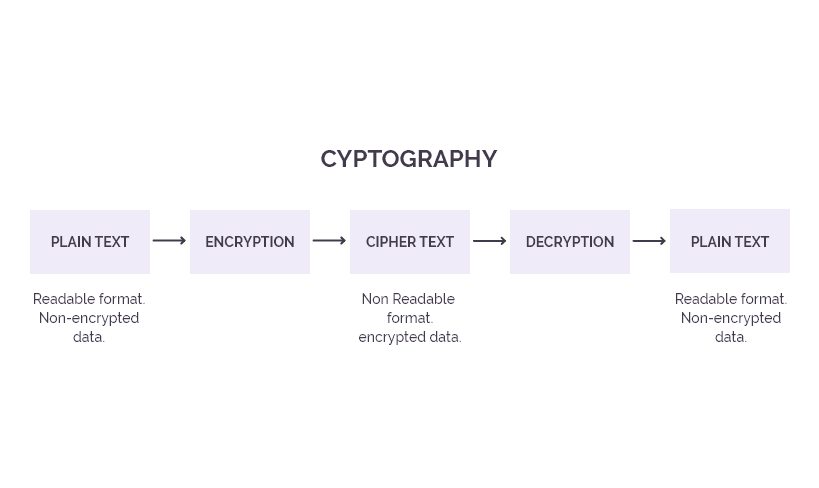

To ensure compliance with various regulations, businesses may need to invest in the latest identity verification technologies, data encryption methods, and robust fraud detection systems. These additional costs increase the operational costs besides adding to the complexity of existing tech stacks and operational processes.

Identifying Red Flags: Proactive Measures

For effective new account fraud prevention, businesses must identify the red flags and take proactive measures to combat account opening fraud attempts. By identifying the red flags and patterns indicative of fraudulent activity, businesses can detect suspicious accounts early and take appropriate countermeasures in time,

Unusual User Behavior and Transaction Patterns

Detecting unusual user behavior and transaction patterns is critical in identifying potential instances of new account fraud.

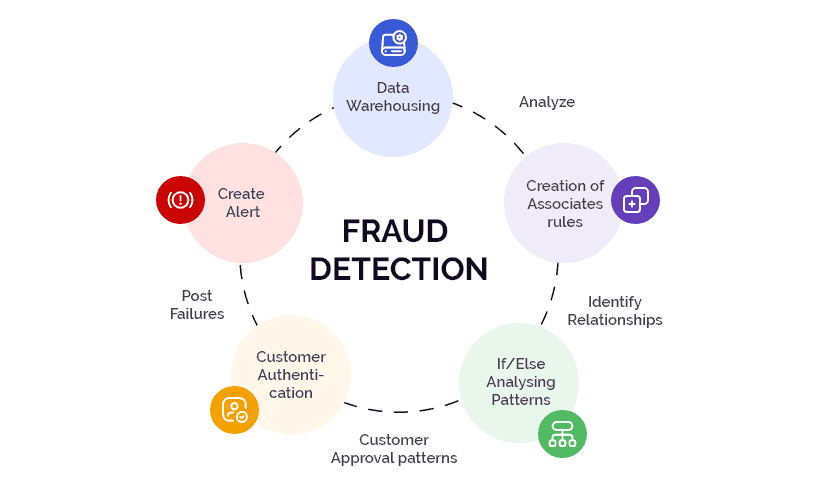

Monitoring for deviations from usual user activity patterns, such as sudden spikes in account creation or high-volume transactions, businesses can flag suspicious behavior for further investigation. Similarly, identifying anomalies in transaction patterns, such as frequent purchases of high-value items or transactions conducted from unusual locations, should raise suspicion. By implementing real-time monitoring systems that leverage artificial intelligence and machine learning algorithms, businesses can quickly identify and respond to abnormal behavior, thereby enhancing their new account fraud prevention efforts.

Some key indicators of a potential new account fraud include:

Spike in Account Creation from Similar IPs

A sudden spike in account creation from similar IP addresses is a big indication of an attempted new account fraud. This is because cybercriminals use bot traffic or scripts to create fake accounts quickly and en masse.

By closely monitoring and analyzing IP address data, it is possible to detect and thwart this unusual activity using preventive measures, such as CAPTCHA challenges or IP blocking.

Businesses must also investigate the source of the IP addresses and cross-reference them with known sources of malicious activity to accurately identify and mitigate potential new account fraud attacks.

Advanced Defensive Strategies

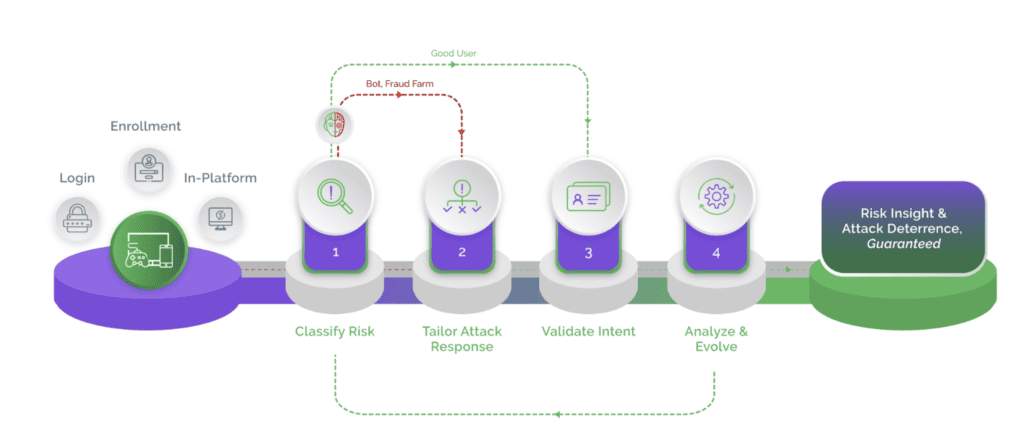

Prioritizing proactive measures and staying vigilant against new account fraud attempts, businesses can fortify their defenses and safeguard their operations, customers, and brand reputation. Advanced defensive strategies against new account fraud encompass a multi-layered approach that combines technological innovations, data analytics, and proactive risk management.

Using multi-factor authentication combined with advanced identity verification methods, such as biometric authentication, behavioral analytics, liveness detection, and document verification, businesses can accurately assess the legitimacy of new accounts. Furthermore, machine learning algorithms and predictive modeling techniques can help detect complex fraud patterns and enable businesses to adapt their defenses in real time.

Businesses must collaborate, share threat intelligence, and provide insights into emerging fraud trends as well as effective new account fraud prevention approaches to refine detection models and enhance collective defenses against evolving new account opening fraud schemes and tactics.

As mentioned earlier, monitoring user behavior for anomalies, such as unusual login locations or account activity that deviates from normal patterns, can help businesses flag and investigate potentially fraudulent accounts promptly.

Leveraging AI and Machine Learning for Detection

Artificial Intelligence (AI) and machine learning can be a powerful strategy in new account fraud prevention, empowering businesses to stay one step ahead of fraudsters and proactively protect their data, customers, and brand reputation. These technologies enable businesses to analyze large volumes of data and identify even the subtle patterns indicative of fraudulent activity, with greater accuracy and speed when compared with traditional methods.

By training machine learning models on the past fraud data, businesses can develop predictive algorithms that continuously evolve and adapt to emerging new account fraud tactics in real time.

AI-driven systems are particularly useful in detecting anomalies in user behavior, transaction patterns, and account opening processes, flagging suspicious activity for further review. Using this proactive approach, businesses can intervene early and mitigate potential losses before they escalate. AI-powered new account fraud detection systems help minimize false positives by leveraging feedback to fine-tune the detection parameters, thereby improving decision-making capabilities.

AI and machine learning help enhance new account fraud detection capabilities by uncovering hidden correlations and sophisticated fraud schemes that may go unnoticed by human reviewers, Furthermore, by automating routine tasks and augmenting human decision-making processes, these technologies enable businesses to streamline operations, reduce manual effort, and allocate resources more effectively.

Implementing Strong Multi-factor Authentication

In addition to encouraging consumers to use strong and unique passwords, businesses must implement strong user authentication measures such as multi-factor authentication (MFA), biometrics, one-time passcodes, or security tokens, to improve users’ account security. A combination of multiple strong user authentication measures enables businesses to create additional layers of defense and prevent bad actors from engaging in fraudulent activities.

Integrating MFA into the account creation process adds a barrier for fraudsters and aids new account fraud prevention. By tailoring MFA to the specific risk profiles of users and transactions, businesses can deploy adaptive authentication mechanisms that can dynamically adjust security requirements depending on several factors such as location, device type, and user behavior.

MFA solutions are capable of leveraging advanced technologies, namely: biometric authentication (e.g., fingerprint or facial recognition) and behavioral biometric analytics to improve security while maintaining superior user experience. MFA systems coupled with regular updation of authentication mechanisms to reflect evolving threats can help businesses bolster their new account fraud prevention efforts and protect sensitive information and genuine customers..

Understanding User Behavior to Flag Anomalies

An understanding into user behavior to flag anomalies requires analyzing underlying patterns in user interactions, transactions, and engagement with digital platforms. An established baseline behavior profile for legitimate users can allow businesses to identify deviations or outliers, indicative of potential fraudulent activity. These anomalies could include unusual login times, uncharacteristic transaction volumes, or irregular navigation patterns.

Businesses can use machine learning algorithms and statistical models to automatically flag these anomalies in real time and prioritize them for review. With this proactive approach, businesses can detect and mitigate potential new account fraud more effectively and mitigate the risk of financial or reputational damage.

Real-time Monitoring and Response Mechanisms

An effective new account fraud prevention strategy, real-time monitoring and response mechanisms can continuously monitor user activities, transactions, and system logs in real time, to help businesses quickly detect suspicious behavior as it occurs. Implementing robust real-time monitoring and response mechanisms empowers businesses to stay ahead of emerging threats and safeguard their assets, customers, and brand reputation.

With automated alerts and notifications, it can trigger immediate response, including actions such as suspending suspicious accounts, blocking fraudulent transactions, or taking additional authentication steps. A rapid response helps mitigate the impact of fraud attempts and prevents further harm.

Real-time monitoring systems, powered by advanced technologies such as machine learning and artificial intelligence, can adapt and learn from past incidents, improving their accuracy and effectiveness over time.

Collaboration and Information Sharing

Collaboration and information sharing are pivotal in the collective fight against the evolving new account fraud tactics. By collaborating, sharing information, exchanging insights, threat intelligence, and real-time data on fraudulent activities, businesses can swiftly detect and respond to new account fraud attempts. Collaboration helps prepare businesses for the evolving trends and techniques of new account fraud, enabling amplification of collective defense capabilities.

Including law enforcement agencies, regulatory bodies, cybersecurity experts, and technology vendors in the collaboration network can help businesses access additional resources, expertise, and legal support to combat new account fraud more effectively.

Utilizing Shared Intelligence for Better Defense

Threat intelligence is the cornerstone of the fight against modern fraud tactics. By harnessing real-time threat intelligence, businesses can gain access to an invaluable wealth of insights and best practices to bolster their defenses. Not only does the shared intelligence provide valuable context and visibility into emerging fraud trends, tactics, and attack vectors, but also empowers businesses to proactively adapt their defenses and stay ahead of evolving threats.

Shared intelligence facilitates collaboration among industry stakeholders, law enforcement agencies, regulatory bodies, and cybersecurity experts, thereby creating an ecosystem where businesses can collectively and efficiently fight new account fraud. Businesses can pool their resources, expertise, and capabilities to develop smarter, more effective, and more accurate new account fraud detection and prevention mechanisms.

Conclusion

The growing challenge of new account fraud necessitates deployment of various strategies for effective new account fraud prevention. As new account fraud techniques continue to evolve, businesses across all industries are facing financial, reputational, operational and regulatory damage.

It is therefore critical that businesses leverage advanced technologies, including AI, machine learning, behavioral biometrics, device intelligence, and others to improve their new account fraud prevention efforts. Proactive measures such as strong multi-factor authentication, real-time monitoring, collaboration, and sharing information with peers both within industries and across sectors, can be useful in gaining valuable insights into emerging fraud trends and bolstering collective defenses.

For a comprehensive and proactive approach to new account fraud prevention, businesses must combine advanced technologies, anti-bot measures, collaborative efforts, and shared intelligence. This will not only help stay ahead of evolving new account fraud techniques, but also adequately protect data, customers, and brand reputation.