Fraud analytics software

Different types of fraud analytics software are used to detect fraudulent transactions and stop them before they can be completed. Fraud analytics software products leverage the latest technologies—and when combined with human expertise, can help preempt fraud.

Fraud analytics software programs help analyze harvested data to detect anomalies and devious behavioral patterns that may be missed by the human eye. These insights are then used to inform company decisions to manage potential threats for proactive fraud prevention. Fraud analytics software is particularly useful in identifying and prioritizing the potential threats a company may face and help choose appropriate controls to mitigate these threats.

How does data fraud analytics analysis software work

Fraud analytics software is a key component of the overall fraud detection efforts of a company. These software products use advanced machine learning algorithms to analyze large volumes of data that help identify risky behaviors indicative of potential fraud and flag them for further review.

Fraud analytics software can spot user actions that deviate from the defined standards and create reports, which enable companies to identify and stop any unauthorized activity before it can become too large to handle.

The process that fraud analytics software products usually follow involves analyzing internal controls to identify lacunae that could act as potential attack vectors and make the company vulnerable to fraudulent activity. Fraud analytics software can also be useful in assessing the extent of damage caused due to a fraud attack, which includes financial, reputational and compliance related losses.

Techniques of fraud analytics software

Fraud analytics software is being used more and more to identify imminent fraud through telltale monitoring. Using data analysis, fraud analytics software helps detect the weak spots that fraudsters could target, thereby strengthening prevention efforts.

There are several techniques that fraud analytics software uses to identify and report fraudulent or suspicious behavior. These techniques include data mining, predictive analytics, and machine learning algorithms. Together, these techniques help identify anomalies and patterns to facilitate taking timely corrective actions. Further, using the latest insights, they help modify existing models and create new ones to improve future fraud detection endeavors.

Why fraud analytics software is needed

The rapidly digitizing business world cannot continue to rely on traditional or legacy fraud solutions. This is because threat actors have leaped ahead using the latest technologies to sharpen their attack tactics. To counter the growing threats, digital businesses need actionable insights that can help them prepare in advance and adapt to the evolving threats.

Fraud analytics software empowers businesses to make data-backed, explainable decisions, which allows them to continually improve their fight against fraud and adapt to the growing threats.

Furthermore, in keeping with the dynamic fraud landscape, regulations are changing, forcing digital business to ensure strict and timely compliance. Using fraud analytics software, businesses can identify and nip the fraudulent activities early in their tracks before they can unfold fully, thus ensuring compliance with complex and growing regulatory changes.

Benefits of fraud analytics software

The digital world is expanding with a greater influx of new users, followed closely by bad actors. To identify these attackers before they can cause any damage, businesses need robust fraud software that can identify hidden patterns and help uncover fraud attempts as early as possible.

Unlike traditional approaches, unsupervised analysis using the latest technological advancements can help identify new patterns, trends, and fraudulent schemes. Fraud analytics software supplement the existing fraud detection efforts by providing additional insights that result in improved fraud prevention capabilities. They can extract data, existing in silos across departments, and aggregate them into a central platform to connect the dots for holistic analysis. These software solutions also generate reports for security teams to clearly understand the areas of improvement.

The Arkose Labs Advantage

Arkose Labs follows an innovative approach to fighting fraud and abuse, which ensures long-term protection from evolving threats. Arkose Labs uses digital intelligence and data from each user session for risk assessment in real-time. Our fraud analytics software helps our partners uncover anomalous user behaviors and patterns and flags them for administering enforcement challenges. Using the most advanced machine learning models, artificial intelligence, behavioral biometrics—and combining them with volumes of digital intelligence—Arkose Labs assigns a risk score to every user, which defines the amount of friction to be applied.

Risk Scoring

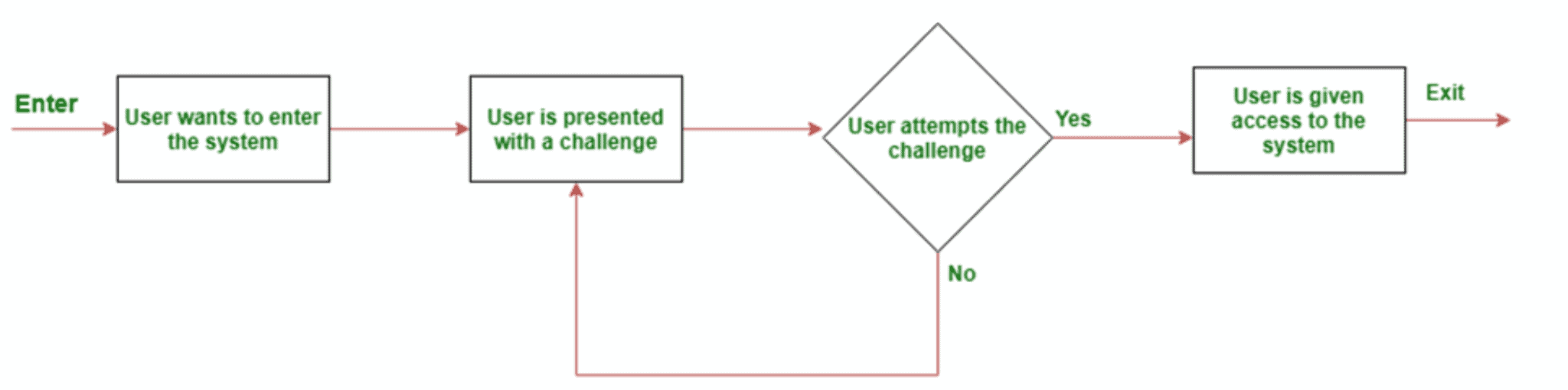

This targeted friction enables good users to pass through smoothly, often unchallenged, which results in bolstering good user throughput and an elevated user experience. On the other hand, bad bots fail instantaneously and malicious humans, click farms, and fraud farms are required to put in extra effort in trying to clear the challenges at scale.

All of this fraud analytics data is fed back into the risk engine, which improves the insights provided to the challenge-response authentication mechanism, further enhancing future risk assessment and the recommendations for the friction needed.

Challenge-response authentication mechanism

Our partners enjoy 24x7 support complete with SOC assistance to handle new threats as soon as they are discovered, thereby minimizing the time to respond and ensuring future-proof protection.