What Is a Bank Account Takeover?

A bank account takeover refers to when bad actors gain access to a consumer’s bank account without their consent. This unauthorized access allows the attackers to perform various fraudulent activities, such as making unauthorized transactions, siphoning off funds, changing account settings, or even locking out the legitimate account holder.

Bank account takeovers are often facilitated by cybercriminals using various methods like phishing, malware, social engineering, or exploiting vulnerabilities in banking systems or third-party services. These attacks lead to serious downstream crimes, including money laundering and identity theft.

The Mechanics of a Bank Account Takeover

Attackers extensively use bots to exploit vulnerabilities in banking systems. Since bots can outperform humans in terms of speed, efficiency, and non-stop execution, they are a popular choice among attackers for large-scale ATO in banking.

Using automated bots, attackers not only achieve scale but can also deceive security teams by making detection and mitigation challenging.

Consequences of Successful Account Takeovers

ATO in banking can have serious ramifications for customers and financial institutions alike.

Impact on Customers

Account takeover fraud in banking can result in immense financial losses through siphoning of funds or fraudulent transactions. It can result in a heightened risk of identity theft with cybercriminals misusing compromised user accounts and credit card numbers for fraudulent purposes, damaging the consumer’s credit scores, credit reports, and online reputation. Consumers may also have to spend disproportionate amounts of time and effort trying to restore their digital identities, causing mental agony.

Impact on Financial Institutions

ATO in banking can cause financial losses such as account recovery, reimbursements to the affected customers, additional burden on customer support services, and investing in additional fraud prevention measures. Further damage includes operational disruptions that can delay customer request fulfillment, resulting in customer annoyance and reputational damage. Negative publicity in the age of social media can spread fast and affect revenue generation potential and the ability to retain or acquire customers. Being highly regulated, banks and other financial institutions may attract fines, penalties, and legal action for failure to ensure data security.

Unpacking the Techniques Used in Account Takeover

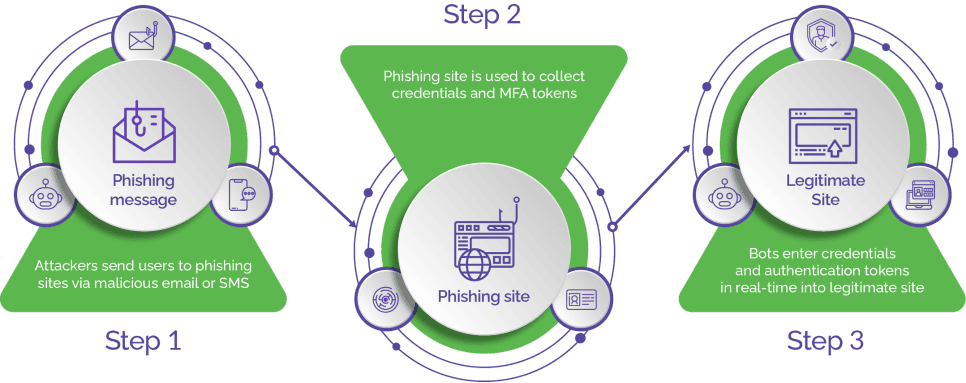

Banks generally do not use email IDs as usernames. Therefore, bad actors leverage automated phishing attacks to impersonate legitimate institutions in the financial services and trick users into sharing their financial and personal information.

Common Methods Employed by Fraudsters

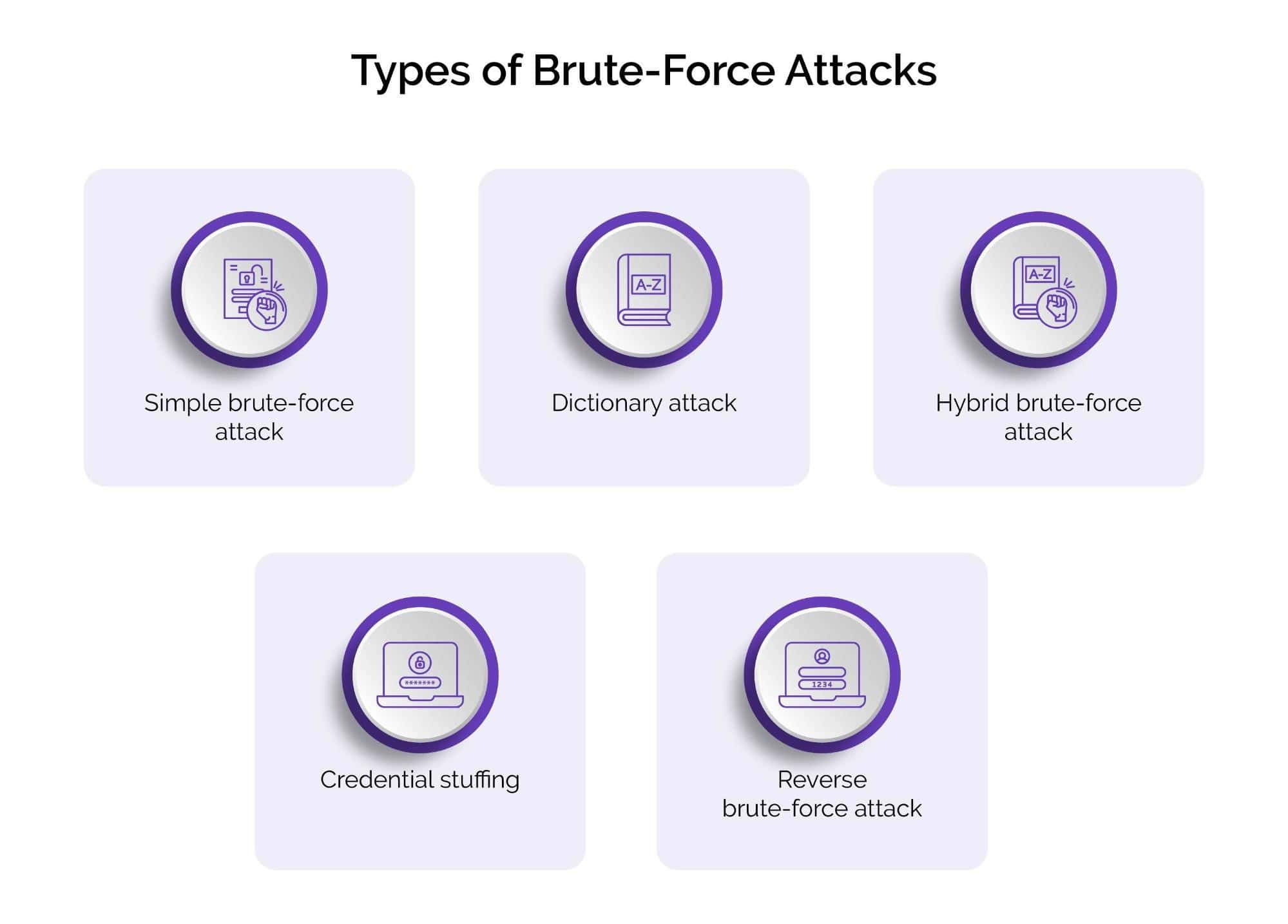

In addition to phishing, bad actors use social engineering tactics, such as impersonating customer support representatives from the bank to manipulate users into providing account access. Automated bot attacks, especially brute force and credential stuffing attacks, enable attackers to validate username-password combinations that are then used to fuel ATO attacks. Bad actors also use malware to infect devices and capture keystrokes that help harvest credentials for use in bank ATO.

Emerging Trends in Account Takeover Techniques

Account takeover fraud techniques continue to evolve with the advancements in technology. One of the latest trends is the use of artificial intelligence and machine learning algorithms to enhance the complexity of account takeover attacks. Leveraging the latest technologies, attackers can execute more targeted attacks, as well as evade the traditional security mechanisms.

Attackers are also using SIM swapping and man-in-the middle attacks to intercept OTPs (one-time passwords), sent through SMS to consumers’ mobile devices, and bypass multi-factor authentication (MFA) systems.

Another notable trend leveraging new attack vectors such as the decentralized finance (DeFi) platforms. Attackers exploit the lacunae in smart contracts and decentralized applications to gain unauthorized access to consumers’ sensitive information and digital assets.

Recognizing Account Takeover Red Flags

For effective fraud prevention, banks must remain ever-vigilant and recognize account takeover red flags.

Warning Signs for Customers

Consumers should be wary of phishing attacks executed through unexpected emails or messages asking for personally identifiable information or login credentials. Consumers must monitor their financial statements regularly to spot any unusual activity such as unrecognized or fraudulent transactions or changes to settings. In case of suspicious activity, or difficulty logging in even with the correct credentials, customers should immediately report it to the financial services provider.

Warning Signs for Institutions

A sudden increase in customer complaints regarding fraudulent transactions or compromised financial accounts can be indicative of a potential account takeover fraud. Unusual account activity, such as multiple failed login attempts, several changes to account information, and a surge in fraud alerts could be an account takeover attempt.

Steps to Take if Faced with an Account Takeover

When faced with an account takeover attack, there are certain measures that consumers and organizations in the financial services can take. These include:

Immediate Actions for Victims

Report the incident to the concerned bank, financial institution, and the concerned law enforcement or regulatory agencies, to seek assistance in taking action against the culprits. Freeze the compromised account to prevent further unauthorized transactions. Change the passwords not only for the compromised online account, but also for other accounts that may share similar login credentials. Closely monitor the financial statements for any suspicious activity.

Reporting and Recovery Process

Once a consumer reports a suspected account takeover attack, the bank or the financial institution must freeze the compromised online account and initiate an investigation. The bank must request account holders to share documentation and details of unauthorized transactions to facilitate the recovery process. The bank must work with the affected account owners to secure the online account, recover any lost funds, and implement additional security measures to prevent future incidents.

How to Prevent Bank Account Takeover: Strategies for Financial Institutions

Financial institutions must consider combining several fraud prevention strategies to effectively mitigate the risk of account takeover attacks. These include:

Enhancing Security Measures

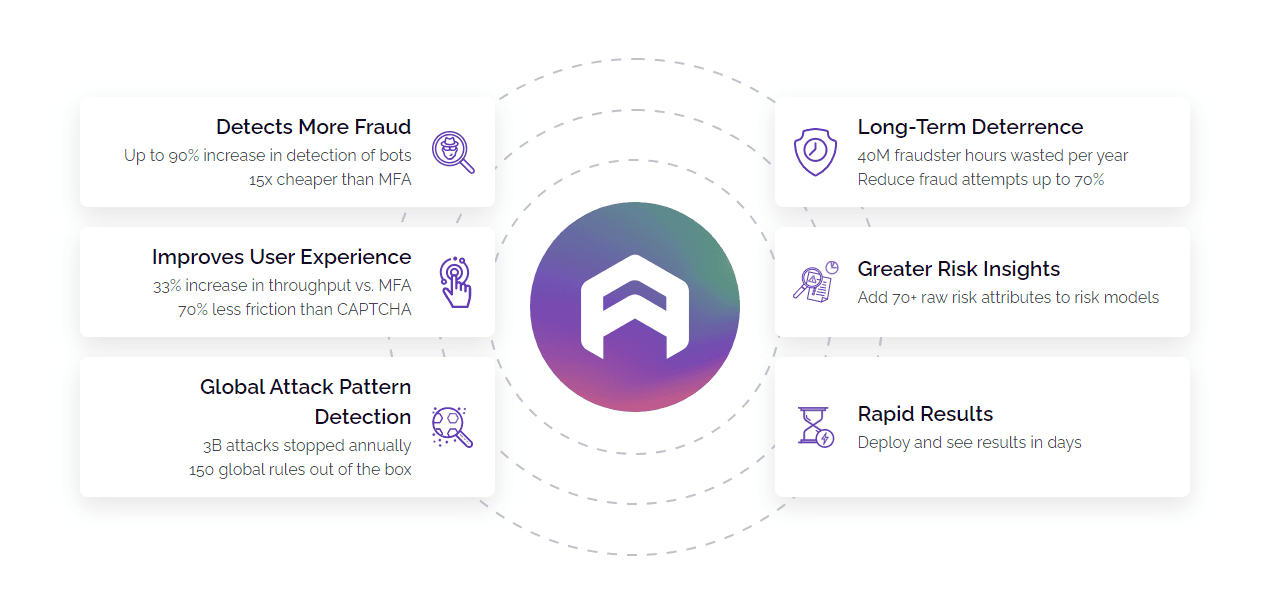

To detect and mitigate bot-driven ATO, banks should implement advanced bot detection solutions that can identify and block malicious bot activity in real time. Smart bot management solutions, such as Arkose Bot Manager, leverage the latest technologies including artificial intelligence, machine learning, behavioral biometrics, device fingerprinting, and more, to analyze user behavior and network traffic patterns in real time. This helps thwart bot-enabled ATO fraud, while maintaining superior customer experience.

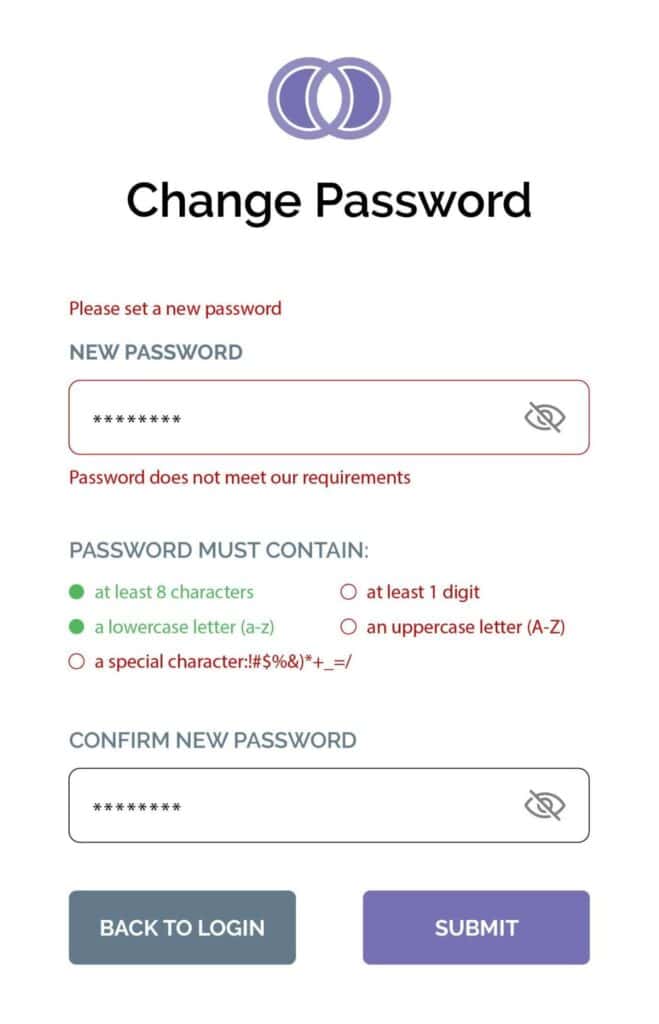

- Enforce robust authentication methods, such as multi-factor authentication (MFA), to add an additional identity verification layer and prevent unauthorized access. Implement real time monitoring systems to detect and flag unusual account activities for review and further investigation.

- Leverage machine learning algorithms to analyze large datasets for anomaly detection in user behavior and effectively identify and respond to evolving bot attack tactics.

- Keep all security protocols and software updated with the latest security patches. Regular pen testing and security audits can help identify potential weaknesses in systems and processes, enabling timely remediation and improvement.

- Collaborate with industry peers because sharing threat intelligence that can help strengthen defenses against evolving bot attack techniques.

Ensuring Continuous Monitoring

With continuous monitoring of account login attempts and restricting the number of login attempts from suspicious IP addresses or devices (rate limiting), banks can detect and prevent account takeover threats effectively. Consider deploying real-time monitoring systems that analyze user behavior, transaction patterns, and network activity, to trigger automated alerts and notifications, enabling quick identification of suspicious activities and taking prompt corrective actions. Establish a dedicated security operations center (SOC) for 24x7 monitoring and proactive threat detection. In addition, regularly review and update monitoring policies and procedures to maintain the effectiveness of fraud detection efforts, while keeping pace with the evolving threats and industry best practices.